Home solar panel grants offer financial support to homeowners, encouraging them to equip their residences with solar panels. These grants, typically issued by governments or various organizations, aim to reduce the costs of installing solar panel systems, making them more accessible for property owners. The provision and sum of these grants can fluctuate based on numerous aspects, including your geographic location, the scope of your solar panel setup, and the particular entity furnishing the grant.

To explore more about the home solar panel grants available in your locality, it would be beneficial to contact your regional government or power supply companies. They might possess details regarding current grants and the procedures to apply for them. Moreover, an online search can assist you in discovering additional organizations that facilitate grants for solar panel installations.

In essence, availing home solar panel grants can significantly reduce the expenses associated with setting up a solar panel system on your property, consequently helping you economize on your utility expenses over time.

1. National Tax Benefits

The Federal Investment Tax Credit (ITC) acts as a significant incentive aimed at making solar energy installations more budget-friendly for homeowners across the United States. It reduces the net cost of installing a solar system by permitting homeowners to subtract a portion of the installation expenses from their federal income taxes. The goal of the ITC is to lessen the financial strain of adopting solar energy solutions.

A 26% tax credit is available for solar installations completed in 2020 or 2021. In August 2022, a legislative move by Congress extended the duration of the ITC, elevating it to a 30% credit rate applicable to installations undertaken between 2022 and 2032. This incentive is slated to undergo a reduction of 26% for setups completed in 2033, followed by a further decrease to 22% for those executed in 2034. The tax incentive is set to be discontinued from 2035, barring any extensions sanctioned by Congress.

To avail of the ITC, homeowners must fill out the appropriate tax documents and substantiate their solar setup expenditures. Utilizing the ITC can diminish the financial encumbrance associated with installing solar panels, letting you reap the rewards of eco-friendly, renewable energy over a prolonged period.

2. State and Local Rebates

Provincial and community rebates are pivotal in enhancing the affordability and accessibility of solar power solutions for homeowners. Granted by either state authorities or local administrative bodies, these reductions considerably lessen the initial expenditure in setting up a solar energy mechanism. These savings’ precise value and qualification conditions fluctuate based on geographical location and prevailing policies.

Generally, these rebates are framed to foster the integration of green energy resources, minimizing dependence on non-renewable fuels. After setting up a solar infrastructure, homeowners can submit applications for these reductions. The rebate value is often determined by the magnitude or total expense of the system. Certain areas might propose additional perks or supplementary incentives for incorporating solar panels on designated property categories or utilizing components manufactured locally.

Undertaking comprehensive research to grasp the array of provincial and community discounts in your vicinity is vital, as they can notably influence the cost-effectiveness of installing your solar panel system.

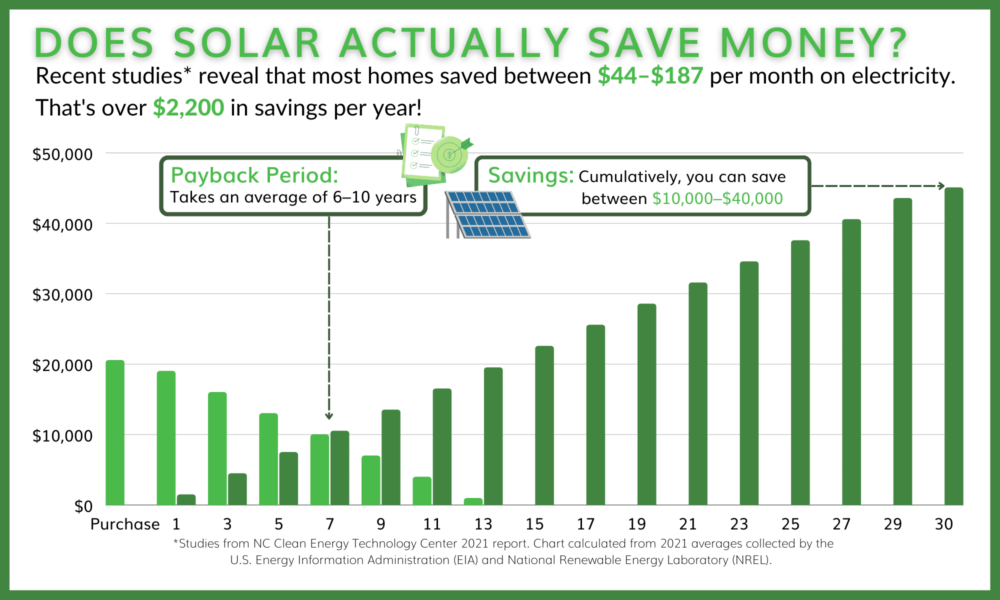

Credit: marketwatch.com

3. Solar Renewable Energy Certificates (SRECs)

Solar Renewable Energy Certificates (SRECs) are an incentive mechanism that rewards homeowners for generating clean, renewable solar energy. In regions where SRECs are available, each unit of electricity your solar system generates earns you one certificate. These certificates have market value and can be sold to utilities or other entities that need to meet renewable energy requirements set by the government.

Selling your SRECs brings in extra income and helps balance out the initial expense of the solar system while improving its financial feasibility. The value of SRECs is subject to change based on the balance between supply and demand, but they typically provide a compelling reason for homeowners to consider solar energy investment.

To take advantage of SRECs, ensure that your solar panel installation is eligible and registered with the appropriate regulatory agency in your region.

4. Net Metering

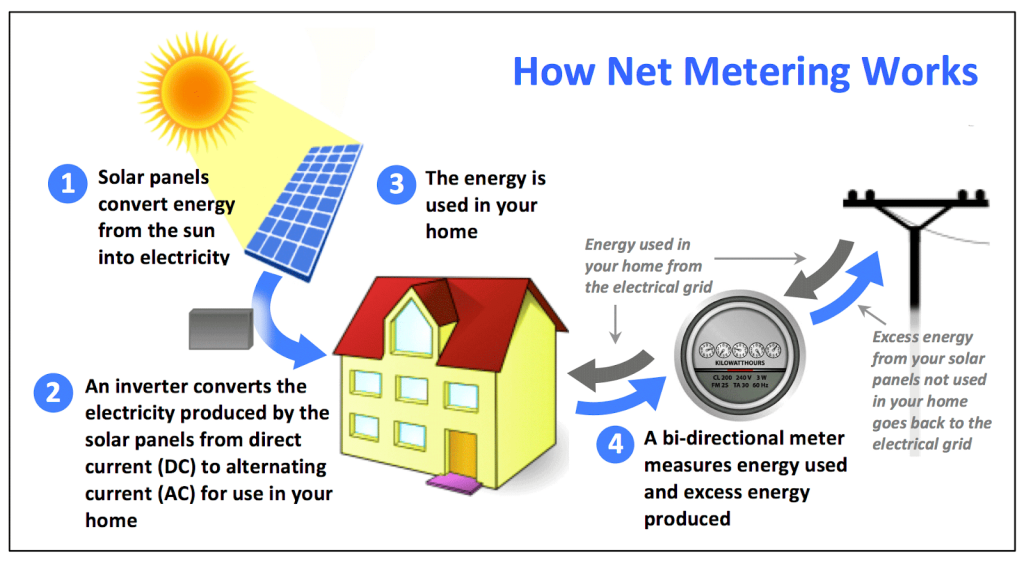

Net metering is a financial arrangement that favors homeowners with solar panel systems interconnected with the power grid. When the solar installation produces more energy than your home requires, the surplus electricity is funneled back into the community grid. This process is tracked by your utility company, which grants you bill credits corresponding to the amount of energy you’ve returned to the grid.

You can utilize these credits to mitigate the costs incurred when you draw electricity from the grid during periods when your solar system cannot meet the energy demand, such as during nights or overcast days. Essentially, net metering enables you to “store” the additional energy you produce for later use, reducing your energy expenditures and recuperating the initial costs of your solar panel setup. Given that net metering guidelines differ across regions, it’s crucial to be familiar with the specific rules applicable in your locality.

Credit: solaflect.com

5. Low-interest loans and Financing

Governments, banking institutions, or entities focusing on green initiatives offer an array of lending solutions to facilitate more accessible access to solar panel installations for homeowners. These financial schemes present lower interest rates and amiable repayment conditions, reducing the immediate economic strain of establishing a solar energy structure.

By opting for low-interest loans, homeowners can distribute the financial responsibility of their solar setup over a lengthier timeframe, making it more financially bearable. Moreover, certain schemes might propose postponement options for repayments, enabling homeowners to commence repayments only once the solar structure is functional and helping in lowering their electric charges.

It is vital to scrutinize and assess the various financial alternatives accessible in your area to pinpoint the optimal solution that accommodates your financial circumstances and optimizes the advantages of your solar panel setup.

6. Community Solar Initiatives

Community solar represents a creative approach to extending the availability of solar energy to homeowners who cannot accommodate solar panel setups on their premises or bear the initial expenses. Community solar, also identified as solar gardens, permits numerous participants to reap the rewards of a singular solar facility. Subscribers to the program are entitled to utility bill credits equivalent to the energy output generated by the solar installation.

Generally supervised by external developers, community solar programs are tasked with creating and keeping the solar facility, thereby lessening the financial obligations of the participants. These schemes are usually characterized by minimal to non-existent initial costs, presenting a viable option for homeowners keen on embracing solar energy but are restricted by financial constraints. Furthermore, community solar initiatives can amplify the outreach of solar power, escalating its acceptance and steering society toward a more environmentally friendly and sustainable future.

To sum up

In conclusion, the realm of solar energy is laden with prospects for homeowners to adopt environmentally responsible, sustainable, and economically viable alternatives. The existence of various home solar panel grants, each possessing distinctive advantages, renders the shift to renewable energy more attainable than ever. Here’s a summary of the top six grants that can metamorphose your residence into a green sanctuary:

- National Tax Benefits: The Federal Investment Tax Credit (ITC) grants significant financial incentives to homeowners, alleviating the economic strain linked with solar panel installations and thus, opening up renewable energy avenues for many.

- Provincial and Local Discounts: These rebates function as crucial elements in boosting affordability and accessibility, with potential savings differing based on geographical region and governing policies.

- Solar Renewable Energy Certificates (SRECs): SRECs function as a financial incentive, granting homeowners a sellable asset that can assist in neutralizing the preliminary costs associated with solar installations.

- Net Metering: This billing mechanism enables homeowners to deposit excess generated energy back into the power grid, which helps diminish energy expenditures and recuperate the primary installation costs.

- Accessible Loans and Financial Schemes: Various financial bodies and organizations offer low-interest loans coupled with accommodating repayment plans, thus making the economic aspect of solar panel installations more manageable.

- Community Solar Initiatives: These programs serve as an encompassing and economical pathway for individuals unable to incorporate solar panels within their premises or those constrained by budgetary limits.

These grants do more than facilitate homeowners in saving money; they play a pivotal role in fostering a greener planet by decreasing reliance on fossil fuels. To tap into the advantages these grants provide, it’s essential to delve into the available options within your locality, engage with local governmental bodies, and sift through financing alternatives that resonate with your fiscal situation.